A chart of accounts is the backbone of financial accounting. Internally, it lays the foundation for assessing operational efficiency and fuels data-driven decision-making. Externally, it serves two arguably more important functions. Firstly, it ensures conformity to the recognition guidance outlined in standards such as IFRS or US GAAP. Secondly, it streamlines the reporting and disclosure processes, ensuring the account structure integrates seamlessly with financial reports.

IFRS and US GAAP adopt a reporting-focused approach, emphasizing recognition, measurement, financial statement presentation, and disclosure. Consequently, their guidance (link: eifrs.ifrs.org | link: asc.fasb.org) provides no defined chart of accounts.

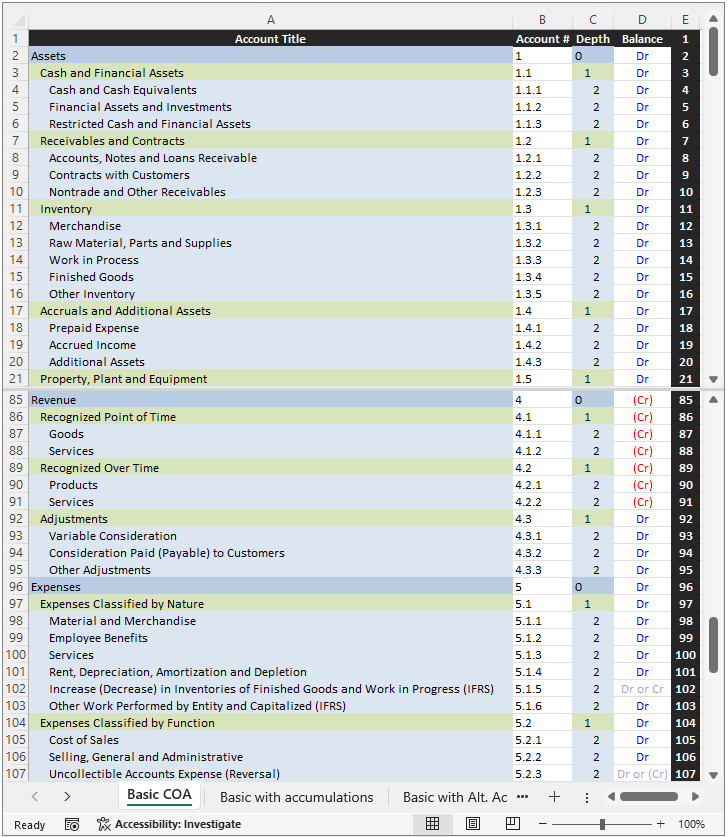

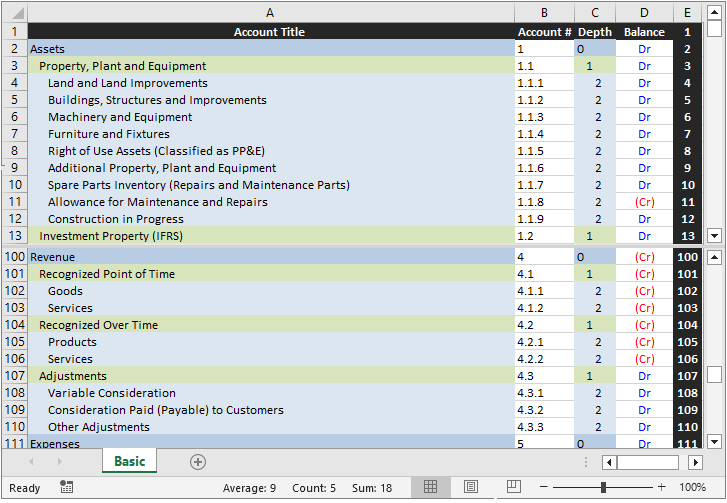

To fill this void, this site has been publishing an IFRS | US GAAP compatible COA since 2010.

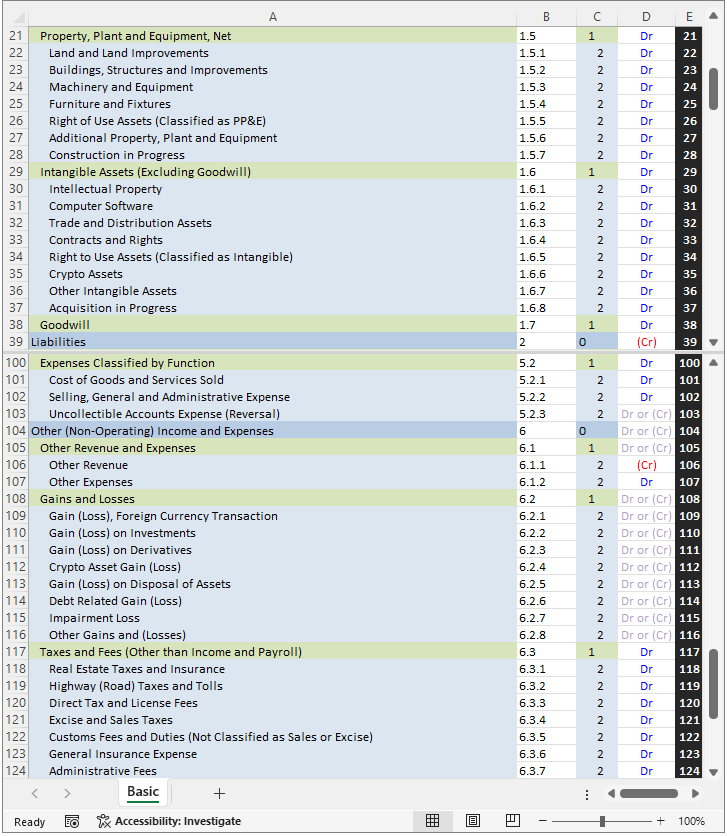

A Google search of the generic term "chart of accounts" yields abundant results. However, most are theoretical rather than practical. For instance, this scheme (among the better ones) limits Machinery & Equipment types to nine. It makes separate recognition of distinct Machinery & Equipment items difficult, if not impossible. It isolates adjustments in a dedicated class, necessitating duplication, made more difficult by the inability of recognizing distinct items of Machinery & Equipment which may each have distinct depreciation periods and/or methods (note: PP&E is depreciated, not amortized).

Others fare worse. This page aptly warns that the wrong chart of accounts will destroy a business before it even starts, yet publishes one primed for that fate.

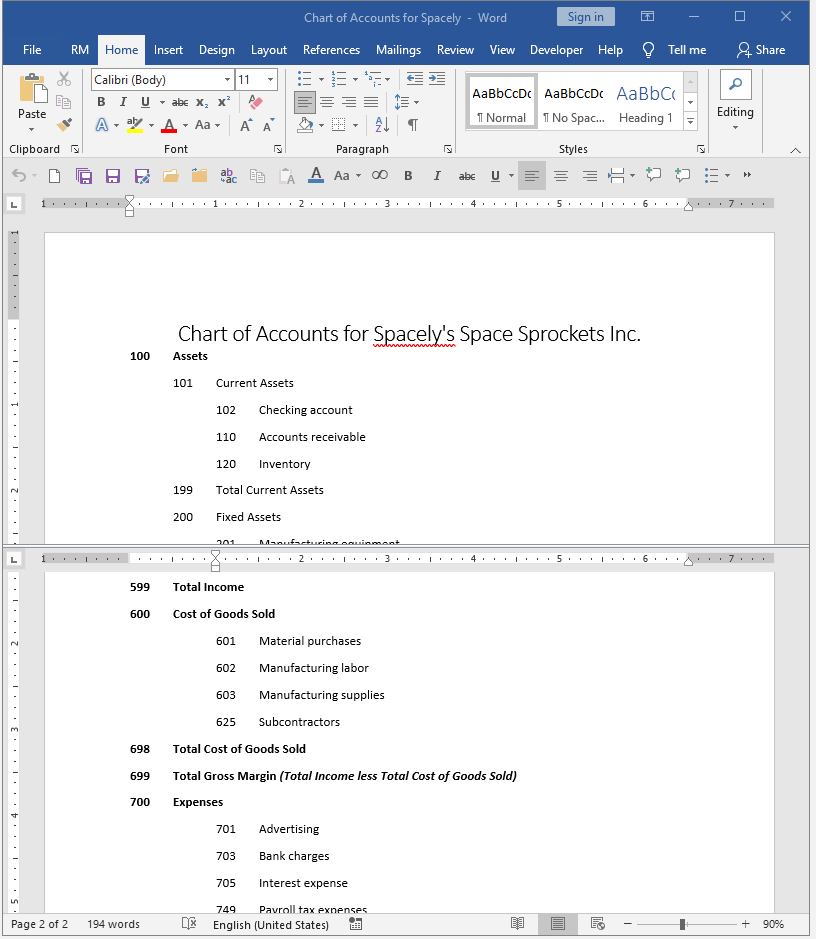

Not only is this "COA" so rudimentary as to be practically useless, it seems to have been designed by someone who does not actually know what an account is. How else can one explain that 599 Total Income, 698 Total Cost of Goods Sold, or 699 Total Gross Margin are listed as accounts when they are actually sub-totals.

Fortunately, TechRepublic has since retracted that article. The sample persists here as a caution: verify quality before making internet purchases (when available, it had cost $49.90).

This page presents three COAs.

The universal COA is suitable for use with IFRS | US GAAP and other comparable accounting standards. In its basic form, it may be used by a small, non-public entity and is available free of charge.

IFRS | US GAAP approaches accounting from a reporting-focused perspective, with emphasis on recognition, measurement, and financial statement presentation and disclosure. As such, it does not prescribe bookkeeping procedures or a standard chart of accounts. Accounting standards in many jurisdictions, e.g., the US, UK, Canada, Australia, Japan, Korea, China, and India, use a comparable approach, leaving structural issues such as chart-of-accounts design to the entity.

By contrast, a number of European Union member states (particularly France, Belgium, Luxembourg and the Czech Republic) implement the EU Accounting Directive through a national GAAP that defines a rigid accounting structure, including a COA that all domiciled legal entities are obligated to follow. Internationally, rigid accounting structures are somewhat less common, and are found in jurisdictions such as Russia, OHADA member states or (for public sector entities) Nigeria.

For example, Czech national standards (link: businesscenter) state this about recognizing revenue (CAS 19. 4.2): "the sale of products and merchandise is, on the basis of relevant documents (such as invoices), credited to the relevant account in account group 60 - Revenue with the corresponding debit made to the relevant account in account group 31 - Receivables (short and long-term) or account group 21 - Cash."

Similarly, French (link: anc.gouv.fr) accounting standard Art. 947-70 (view pdf) states: "… Les montants des ventes, des prestations de services, des produits afférents aux activités annexes sont enregistrés au crédit des comptes 701 "Ventes de produits finis", 702 "Ventes de produits intermédiaires", 703 "Ventes de produits résiduels", 704 "Travaux", 705 "Études", 706 "Prestations de services", 707 "Ventes de marchandises" et 708 "Produits des activités annexes"."

Many jurisdictions either allow or require public interest entities (usually entities traded on capital markets) to apply IFRS alongside national GAAP.

In these jurisdictions, the universal and/or IFRS charts of accounts presented on this page may be used for IFRS purposes. However, mapping these COAs to, and particularly using them in place of, prescribed national COAs may conflict with national legislation.

For example, in the Czech Republic, the Accounting Act 563/1991 paragraph §19a (1) states:

"An [unconsolidated] entity that is a trading company and is an issuer of investment securities admitted to trading on a European regulated market shall apply international accounting standards regulated by European Union law (hereinafter referred to as "international accounting standards") for accounting and the preparation of financial statements" [paragraph § 23a requires IFRS at the consolidated entity level].

This implies, if the COA presented here is used for IFRS bookkeeping purposes and IFRS recognition guidance is applied correctly, it may (implicitly) used in place of the chart of accounts mandated by the same law but only by a trading company (consolidated entity) that is an issuer of investment securities admitted to trading on a European regulated market.

Nevertheless, the Income Tax Act 586/1992 §23 (2) states:

"The tax base is determined a) from the net income (profit or loss), always without the influence of International Accounting Standards, for taxpayers required to maintain accounts. A taxpayer that prepares financial statements in accordance with International Accounting Standards regulated by European Community shall apply for the purposes of this Act to determine net income and to determine other data decisive for determining the tax base a special legal regulation [CZ GAAP]). When determining the tax base, entries in off-balance sheet account books are not taken into account, unless otherwise provided in this Act. ..."

Thus, since Czech accounting law assumes the mandated chart of accounts will be used for accounting purposes, if a different chart of accounts is used, it will need to yield the same result as if the mandated chart or accounts were used. While this is not impossible with careful mapping and associated adjustments, it is generally more practical to use the mandated national GAAP COA for Czech accounting and taxation purposes, and a separate IFRS compatible COA for IFRS recognition, measurement, reporting, and disclosure purposes.

As a general rule, only publicly traded entities have a formal obligation to apply IFRS or US GAAP guidance. As such, their accounting system must be robust enough to fulfill the extensive recognition and measurement guidance outlined in these standards.

Non-public entities in jurisdictions that do not mandate accounting practices have more flexibility and may elect to use any structure they choose. Nevertheless, a sound account structure will help any business, regardless of size, optimize its operational efficiency and fuel data-driven decision-making. Equally important, it allows the entity to fulfill the tax reporting obligation shared by all entities, regardless of size or ownership structure.

Since the IFRS SME standards | ASC non-public entity guidance is the backbone of accounting for all entities, COAs that reflect this guidance are useful to all but the smallest businesses.

Businesses whose accounting consists of tracking cash flow so they can report income to a tax authority have no need for a COA or any formal accounting system. Their accounting needs can be met by simply downloading a bank statement and adding up all their cash receipts and disbursements.

As anyone who has ever started a business knows, starting a business is the easy part. Keeping it running smoothly and profitably is where the real challenge lies. To help those just starting out, this site publishes workable, basic COAs, that can be expanded as needed, free of charge. After all, every business that survives the startup phase makes the business community richer and more diverse so is in everyone's best interest.

The IFRS | US GAAP COA is more specialized. The IFRS COA also mirrors the structure of IFRS financial statements, which helps streamline the report drafting process. The basic versions of each are also offered free of charge.

IFRS approaches accounting from a reporting-focused perspective, with emphasis on recognition, measurement, and financial statement presentation and disclosure. As such, it does not prescribe bookkeeping procedures or a standard chart of accounts. Entities operating in jurisdictions such as the UK, Canada, Australia, Japan, Korea, China, India, etc. may generally define any COA provided it yields a financial report consistent with IFRS guidance.

Nevertheless, as designing a workable COA is a time consuming and laborious process, many entities prefer to use an off-the-self version particularly if it can be, with minimal effort, adjusted to reflect the entity’s financial structure.

US GAAP approaches accounting from a reporting-focused perspective, with emphasis on recognition, measurement, and financial statement presentation and disclosure. As such, it does not prescribe bookkeeping procedures or a standard chart of accounts. Entities operating in the United States may define any COA provided it yields a financial report consistent with US GAAP guidance.

Nevertheless, as designing a workable COA is a time consuming and laborious process, many entities prefer to use an off the self-version particularly if it can be, with minimal effort be adjusted to reflects the entity’s financial structure.

While only publicly traded entities generally have an obligation to apply IFRS | US GAAP, IFRS (particularly the IFRS SME standard) | US GAAP (particularly the Private Company Council framework) is the backbone of accounting for all entities (except those domiciled in jurisdictions that mandate accounting practice as discussed above.)

Thus, even small, private entities are better off using an account structure consistent with the guidance, particularly if they have ambition to grow and eventually become large, public entities.

The advanced versions of all three COAs include cross-references to the IASB | FASB published XBRL taxonomies.

Universal COAs IFRS COAs US GAAP COAsUpdate: January 2026

The US GAAP COA has been updated to reflect changes in the 2026, FASB published XBRL taxonomy.

An update to the IFRS and Universal COAs will be provided once the IASB publishes its 2026 taxonomy.

The 2025 version has been revised and updated to improve operability.

The XBRL cross-reference sheet has been updated to reflect the 2025 FASB-issued taxonomy. Once the IASB publishes its 2025 taxonomy, it will be updated to reflect any changes.

For reference, the 2024 pro versions will remain available for download during a transition period.

Universal COA (html)

While generally comparable, IFRS and US GAAP do not provide identical guidance.

Thus, while this universal COA may be used for dual reporting purposes, adjustments will be necessary. Adjustments will also need to be made if, for example, a US GAAP parent consolidates its IFRS subsidiary or vice versa.

The Illustrations section outlines most, common differences between IFRS and US GAAP.

We strongly suggest reviewing the Illustrations section thoroughly before attempting to use the universal COA for dual reporting and/or consolidation purposes.

IFRS COA (html)

US GAAP COA (html)