This chart of accounts is suitable for use with IFRS.

The IASB (link: ifrs.org) does not define an IFRS COA. To fill this void, this site has been publishing COAs since 2010.

This is not the only site to publish a COA.

A Google search quickly yeilds some relatively workable examples, some less useful results but more often sites that would rather talk about it than do it.

Strategic CFO (link: strategiccfo.com) publishes one of the better better examples.

While it is better than some examples, it still is not particularly good. Its account numbering is not easily expandable. Inventory has missing material. Accumulated depreciation/amortization is presented as separate account class, which makes the COA cumbersome (each unit of account appears in two places). Organization costs are not an asset (at least not under IFRS or US GAAP). Rent is rarely accrued. Subclassifying Cost of Goods Sold by product is useful from a managerial perspective, but in practice it will lead to hundreds of duplicate sub-accounts or the need to reclassify expenses items like direct material or direct wages leading to messy accounting. Also, not including depreciation expense in COGS (it is all listed in operating expenses) ignores basic, full absorption costing principles. The list of items classified as operating expenses seems fairly arbitrary.

We could go on, but since the site does not charge for its COA, you get what you pay for.

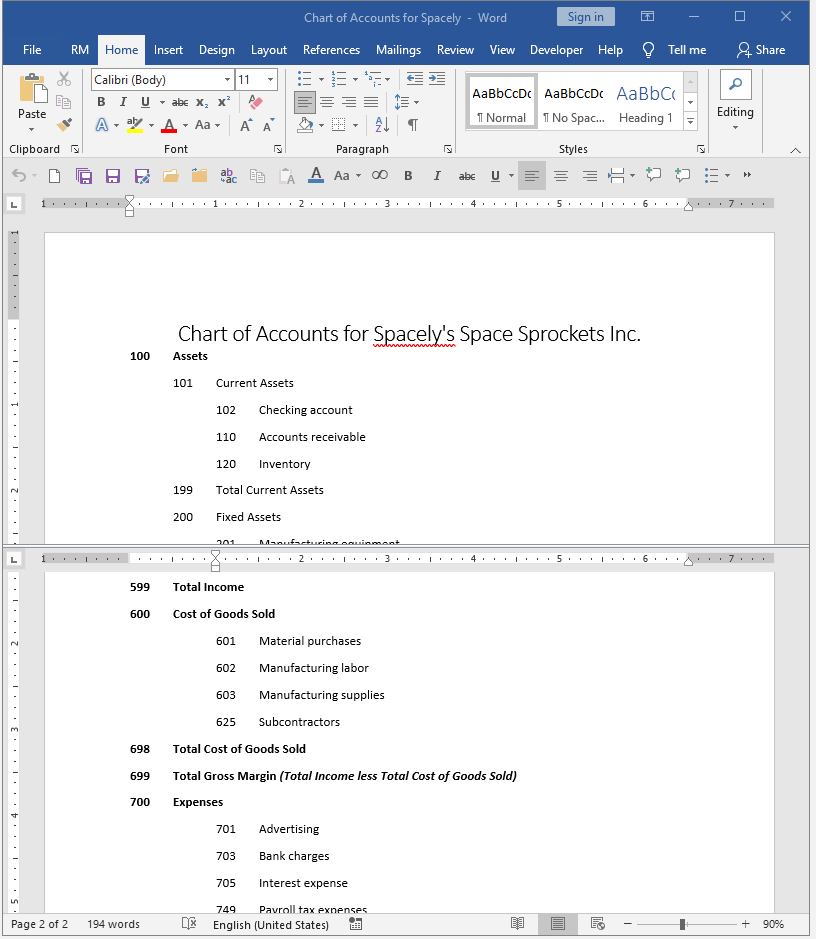

This site, while it correctly points out: The wrong chart of accounts will destroy a business before it even starts publishes one that is so poor, it may just do exactly what they warn against.

In my opinion (who am I), this COA is so bad that charging money for it is an insult.

Not only is it so rudimentary as to be practically useless and structured in a way to make it practically unscalable, it was created by someone who does not actually know what an account is.

How else can one explain that "599 Total Income, 698 Total Cost of Goods Sold, or 699 Total Gross Margin" are listed as accounts when, in fact, they are financial report sub-totals.

While this piece of work cannot be republished here in its entirety, I can shown an edited sample so hopefully the visitors to our site will not waste $49.90 downloading it from Techrepublic.

This site (link: toptal.com) discusses the importance of a good COA at great length.

It does not, however, get around to publishing one.

Why? Probably because talking is easier than doing.

For example, when we design a custom COA for a company, if the company is small and simple (one division, not listed on any exchange), it can take days to make sure the COA fulfills both the company's tax reporting obligations and management's informational needs.

And no, management cannot simply ignore tax reporting like the site we are criticizing suggests.

Sure, it is true that "tax and audit CPAs have the custom reporting software to easily convert your management-oriented chart of accounts into their format. Just be sure to make it easy for them by incorporating any special accounts they need into your remodeled chart accounts."

The problem is the "Just be sure to make it easy for them by incorporating any special accounts they need into your remodeled chart accounts." is the hard part and, unless done very well, often leads to a tax CPA's services being more costly than they would otherwise have been.

We suppose this may also be the reason why this tax CPA makes this suggestion.

Then again, maybe we are just being cynical.

Once the company becomes more complicated (multiple divisions, multiple tax jurisdictions), it can take weeks.

Once the company becomes complicated (listed on an exchange with an IFRS and/or US GAAP reporting obligation), it can take months.

Even the standard COAs downloadable here were not easy.

For example, the universal COA (and all of its versions) took almost a year and over 1400 man hours.

Then again, no ever said creating a COA for usable with two different reporting standards and two (generally incompatible) XBRL taxonomies was going to be a stroll in the park.

In the end, managment can decide what works best for them and their company.

In general, two approaches are possible:

A. base the COA on financial accounting.

B. base the COA on managerial accounting.

Approach A requires that an accounting standard first be selected.

In general, the possibilities include: US GAAP, IFRS, tax accounting rules or a national GAAP.

In this respect, the management of a company operating in a country that prescribes a national GAAP has it easy.

Instead of having to decide which standard will work best, they either apply the national GAAP or go to prison.

A more detailed discussion of national GAAP is available in the release notes.

Once that standard has been selected, the COA is designed around that standard's recognition guidance. The more closely it adheres to that guidance, the less likely mistakes in applying that guidance will be made.

Approach B does not require an accounting standard be selected at all. Instead, management designs the COA around its own needs using managerial accounting principles.

The advantage of approach A is that it makes creating the financial report relatively straight forward. This is especially important for a company that must submit that report to a regulator like the US SEC.

A common account structure is also important for a company with operating in multiple jurisdictions. Without a common COA, consolidating these divisions is daunting (if possible at all).

The advantage of approach B is that it makes the job of managing a company easier.

For example, there is no requirement in any accounting standard that companies break sales down, for example, by product type, store location, in-store location, shelf-space height, proximity to other merchandise or any of a myriad of data points useful to management in evaluating how a particular merchandise item contributes to the company's bottom line.

In the United States, the question of which approach is better rarely comes up.

One reason, most companies in the US have no divisions in other countries. Some Americans even have trouble finding a country like the Czech Republic on a map.

Another reason, unless they cross the IRS's threshold for accrual accounting, preparing a tax return is pretty much: receipts - disbursements = taxable income (even if some tax CPAs make it out to be some kind of dark art).

Obviously, an accountant working at such a company can stop reading (assuming he or she has gotten this far) and visit some other site.

This site is not meant to address the needs of these companies.

Instead, it is designed to address the needs of companies that must, for whatever reason, apply US GAAP or IFRS guidance in full.

However, this freedom disipates when a company registers with the SEC (US GAAP) or EU member state regulator (IFRS).

The reason is simple.

If the company does not apply one or the other standard correctly, its management is criminally liable.

In the United States, Sarbanes–Oxley establishes management’s reporting obligations.

Link: govinfo.gov:

`Sec. 1350. Failure of corporate officers to certify financial reports

(a) CERTIFICATION OF PERIODIC FINANCIAL REPORTS- Each periodic report containing financial statements filed by an issuer with the Securities Exchange Commission pursuant to section 13(a) or 15(d) of the Securities Exchange Act of 1934 (15 U.S.C. 78m(a) or 78o(d)) shall be accompanied by a written statement by the chief executive officer and chief financial officer (or equivalent thereof) of the issuer.

`(b) CONTENT- The statement required under subsection (a) shall certify that the periodic report containing the financial statements fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange Act pf 1934 (15 U.S.C. 78m or 78o(d)) and that information contained in the periodic report fairly presents, in all material respects, the financial condition and results of operations of the issuer.

`(c) CRIMINAL PENALTIES- Whoever--

`(1) certifies any statement as set forth in subsections (a) and (b) of this section knowing that the periodic report accompanying the statement does not comport with all the requirements set forth in this section shall be fined not more than $1,000,000 or imprisoned not more than 10 years, or both; or

`(2) willfully certifies any statement as set forth in subsections (a) and (b) of this section knowing that the periodic report accompanying the statement does not comport with all the requirements set forth in this section shall be fined not more than $5,000,000, or imprisoned not more than 20 years, or both.'.

department or agency of the United States or any case filed under title 11, or in relation to or contemplation of any such matter or case, shall be fined under this title, imprisoned not more than 20 years, or both.While few countries have legislation quite as strict, violating securities law is a serious offence practically everywhere.

This site publishes COAs for these kinds of companies.

The COAs available for download here are specifically designed to be compatible with US GAAP and/or IFRS.

Obviously, since managerial accounting is important to management, the COAs are also designed to be expandable.

However, as every company is different, it is not possible for a standardized COA to meet every managements’ needs.

Instead, it requires a bespoke COA, tailored specifically to fit each specific company.

To help small companies just starting out, the COA on this page is free to use at no charge.

Even though it is free, it is perfectly workable.

More importantly, it can be scaled to grow with the business as it moves from startup to IPO.

Small, private companies do not need much of a COA. Something like this (Link: quickbooks.intuit.com) will do.

But if a company wants to grow, it will need something more robust, especially if it intends to eventually list on an stock exchange or sell itself to a listed corporation.

For this reason, the COAs published on this site are designed to be scaled in a way that would suit even a multinational company with hundreds of divisions.

Obviously, as a company grows, we would be glad if it subscribed to this site or used some of our services.

But even if it never does, we are still happy to help anyone brave enough to start a business by providing a workable COA free of charge.

Professional view allows downloads all the COAs in Excel format.

Professional view costs €69.90 for one year.

Professional view does not renew automatically.

Get professional view or log in.

Why is a subscription necessary?

Maintaining a web site and creating its content involves a cost.

Like many sites, we could sell selling advertising to cover this cost.

However, we would rather not treat our visitors as merchandise to be sold advertisers.

Instead, we rely those visitors who find our content useful enough to support this site by subscribing.

In the past, this site had this to say about a universal COA, compatible with both IFRS and US GAAP.

Why not a universal IFRS and US GAAP compatible chart?

While IFRS and US GAAP have converged, they are far from identical, especially the details.

For example, a quick comparison of their respective XBRL taxonomies ( link: bigfoot.corefiling.com / link: xbrlview.fasb.org) reveals significant differences in both scope and emphasis.

While it is theoretically possible to create a universal chart, it would either be cumbersome or so simplified as to be misleading.

From a practical perspective, most companies use either IFRS or US GAAP or a national GAAP as their primary system.

If they need to produce a financial report consistent another standard, it is far easier to reconcile at the statement than account level.

When people called to ask, I (who am I) advised them to choose either the IFRS or US GAAP COA as a primary and make adjustments at the report level or retain our services when they preferred to have someone else do it.

While neither IFRS nor US GAAP provide any guidance as to the chart of accounts that must be used, to be usable for IFRS and/or US GAAP purposes, the COA must be consistent with the guidance IFRS and/or US GAAP do provide.

Fortunately, in most cases, IFRS and US GAAP provide similar guidance.

Unfortunately, their guidance is rarely identical so some adjustments must inevitably be made.

For example, IFRS allows PP&E and intangible asset revaluation, while US GAAP does not. IFRS allows (some) development costs to be capitalized, while US GAAP does not. IFRS does not recognizes operating leases for lessees, while US GAAP does.

Note: although US GAAP continues, unlike IFRS, to allow lessee's to classify leases as operating, the guidance provided by ASC 842 and ASC 840 is quite different.

While in the past operating leases were accounted for as rentals, currently they are accounted for in almost exactly the same way as financial (capital) leases, with the only different being the way the interest associated with liability is treated.

Even standards that were originally conceived to be identical, such as IFRS 15 | ASC 606, can eventually diverge.

For example, ASU 2016-20 added paragraph 606-10-50-14A to ASC 606, which made the guidance for variable consideration in a sales-based or usage-based royalty promised in exchange for a license of intellectual property under US GAAP different than under IFRS.

True, this difference is subtle, but it is still a difference that will, in certain situations, require an adjustment.

Another source of difficulty: the way IFRS and US GAAP structure their financial reports.

Under IFRS, balance sheets are presented fixed assets first, while US GAAP reports start with cash. IFRS allows both an order of liquidity and a current-non-current balance sheet format, while US GAAP only accepts the latter. On the income statement, IFRS accepts both a nature and function of expense classification scheme, while US GAAP only allows the latter.

I established GAAP.cz, Ltd. in 1994 to serve subsidiaries of US corporations based in the Czech Republic.

In 2002, after the EU adopted IFRS, we began to serve a wider range of companies.

Although my original intent was to focus on training and advisory services for local companies, after we posted our first chart of accounts in 2010, I began seeing visitors from all over the world.

At first, most were happy to simply download the standard COA and make any necessary adjustment themselves.

Soon however, we began receiving requests for customized COAs, reflecting the particular needs of each individual company.

We are generally able to fulfill these requests for most companies withing a week or two.

More recently, we have also begun receiving requests not only for customized COAs, but also the adjustments necessary to take the result IFRS to US GAAP (or vice versa), including the aggregations needed to generate the financial report, footnote disclosures and, in some cases, XBRL tagging.

Fortunately, as people have become accustomed to working remotely, this task no longer demands a physical presence. It does, however, require that we familiarize ourselves with the company and its operations. As a result, we accept these assignments on a case by case basis.

Occasionally, we also receive requests for adjustments that would take a national GAAP to IFRS/US GAAP (or vice versa).

For reasons discussed elsewhere on this site, we only accept such assignments when the client can demonstrate this procedure would not violate any national law or regulation.

For more information about our services, please visit our services page or contact us.

However, many pointed out that their companies operate in multiple jurisdictions, must apply various standards and using, for example, a US GAAP derived COA at an EU operation with an IFRS reporting obligation was not a palatable alternative.

What they preferred was a universal COA, which could be deployed on a company-wide basis without being overtly subordinated to any particular reporting standard.

As to my main reservation: the incompatibility of IFRS and US GAAP XBRL. Most told me that they did not care about XBRL. Either they had no need to publish XBRL tagged reports or it was far easier to map the final report to XBRL than try to do it at the CAO level or that they simply outsourced this task.

The IASB defined XBRL taxonomy (link: bigfoot) is significantly different from the FASB defined taxonomy (link: TORCS), a difficulty exacerbated by the close working relationship between the FASB and SEC.

For example, each year the SEC simply ratifies the FASB's taxonomy while ESMA publishes its own: the European Single Electronic Format (ESEF).

Not that this comradery is all sunshine and puppy dogs.

Since the SEC's staff, in the thrall of exuberant convolution, mesmerized by pedantic assiduousness and ensconced in a regulatory ecosystem whose corporate mindset eschews practicable solutions have a say, compared to the relatively readable 7,256 line IFRS taxonomy, the US GAAP version tips the scales at 44,291.

XBRL has also been the main reason why this web site has avoided publishing a universal COA.

Specifically, when a COA is designed to be easily mappable to a one taxonomy, its structure will not correspond to the other.

When XBRL was still new, our clients indicated that being able to map accounts to an XBRL taxonomy was a priority.

The feedback we received from the site's visitors also indicated that this was important to them.

However, based on what we have been hearing lately, it seems priorities have changed.

Currently, practitioners seem to prefer a COA organized in a rational and consistent manner over one reflecting a particular XBRL structure.

Especially since, that structure is not always as logical or consistent as it could be.

Sometimes concepts are added for systematic reasons. Other times ad hoc, to address a specific policy concerns.

A LongTermTransitionBond concept, for example, is included in US GAAP XBRL because it is a bond under the Competition Act in which the proceeds of are required to be used principally to reduce qualified stranded costs and the related capitalization of a utility not because it is an item most companies need to account for.

Or in IFRS XBRL, ProgrammingAssets deserve their own concept name while Broadcasting Rights do not (no reason why is given). But, although they are clearly intangible assets, they are disclosed in MiscellaneousAssets between InterestReceivable and InvestmentsOtherThanInvestmentsAccountedForUsingEquityMethod as if they were financial.

Other times it does not seem the concepts are consistent with common practice.

For example, Commercial paper is commonly understood to be a money-market security issued (sold) by large corporations to obtain funds to meet short-term debt obligations (for example, payroll) and is backed only by an issuing bank or company promise to pay the face amount on the maturity date specified on the note (link: wikipedia).

However, US GAAP XBRL defines CommercialPaperNonCurrent as Carrying value as of the balance sheet date of long-term unsecured obligations issued by corporations and other borrowers to investors (with maturities initially due after one year or beyond the operating cycle if longer), excluding current portion.

The main reason is that most practitioners have concluded that mapping a financial report's line items to a taxonomy more practical than attempting to map individual accounts.

Further, they have indicated that, since individual transactions and events must be accounted for day-in, day-out and often by relatively inexperienced staff, a logical and well organized COA is more important than a COA subordinated to a taxonomy that was never designed with accounting ease in mind.

Another, fairly large group of practitioners have indicated that they do not care about XBRL at all. They either do not need to report using XBRL, or they simply outsource this task to an outside advisor.

For this reason, these universal COAs do not include XBRL cross-references (except the last, most detailed COA, which also includes comments to, hopefully, aid in any mapping process).

BTW, this is the exact opposite feedback than what I received when XBRL was still fairly new.

Back then, our clients insisted that XBRL tagging at the account level was critically important.

Oh well, I guess the client is always right, even when they change their mind.

In other words, people were telling me: since IFRS and US GAAP are focused on reporting and disclosure rather than defining accounting procedures, we do not care if the COA is specifically compatible with either one or the other. What we do care about is that it is logically and systematically structured so it can be applied (often internationally) by a (often local) staff not specifically trained in either IFRS or US GAAP. This way the COA can serve as the basis on which our reporting specialist can draft the report required by each particular jurisdiction.

As I feared, the process turned out to be long, taking over a year, involved, hundreds of revisions, and way over budget.

The accounting standards of countries such as the UK, Canada or Australia do not prescribe a particular chart of accounts, so can be considered comparable to IFRS and US GAAP.

In contrast, the accounting legislation of countries such as France, Austria or the Czech Republic does prescribe a mandatory chart of accounts, so cannot be considered comparable to IFRS and US GAAP.

The COAs available for download from this site should not be used with incomparable standards.

Legal entities domiciled in some countries are not permitted to deviate from the COAs prescribed by national law and, in some these countries, doing so is a criminally punishable act.

Consequently, the COAs downloadable from this site cannot used in conjunction with national GAAP standards unless this procedure is permitted by those standards or national law.

For example, in the European Union, there are two layers of accounting standards. One (IFRS) is required by Regulation: EU 1606/2002 (link: ec.europa.eu) and the other (national GAAP) is governed by Directive 2013/34/EU (link: eur-lex.europa.eu).

While IFRS is created by the IASB (a non-profit, international organization, link: eifrs.ifrs.org) and so is not law, national GAAP is created by member state legislatures and so is law.

The difference is that while IFRS is judgmental, national GAAP is legalistic. While IFRS focuses on disclosure and reporting, national GAAP concentrates on accounting procedure. While IFRS does not prescribe (or even discuss) a chart of accounts, national GAAP prescribes one, making unauthorized deviations from this COA punishable by law.

Nevertheless, as EU 1606/2002 requires IFRS for public companies (at the consolidated entity level), national law must accommodate this regulation. This implies that EU member states may allow legal entities to use IFRS in place of national GAAP in certain situations.

For example, in the Czech Republic, the Accounting Act 563/1991 paragraph §19a (1) states:

"An [unconsolidated] entity that is a trading company and is an issuer of investment securities admitted to trading on a European regulated market shall apply international accounting standards regulated by European Union law (hereinafter referred to as "international accounting standards") for accounting and the preparation of financial statements" [paragraph § 23a requires IFRS at the consolidated entity level].

This implies that, since the COA downloadable from this site may be used for IFRS purposes and IFRS shall be applied for accounting purposes, using the COA downloadable from this site in place of the prescribed CZ GAAP COA is (implicitly) allowed, but only for a trading company (consolidated entity) that is an issuer of investment securities admitted to trading on a European regulated market.

For example, in the Czech Republic it would be possible to use the COA downloadable from this site in place of the COA prescribed by CZ GAAP in the those situations, even if CZ GAAP cannot be ignored altogether.

Although it is an IFRS/US GAAP advisory firm, the owner of this web site is a legal entity domiciled in the Czech Republic. As a result, it must use CZ GAAP for statutory accounting purposes.

While we do not have similar, in-depth experience with other member state accounting laws, since the Czech Republic is subject to the same EU directives and regulations as all other member states, its accounting legislation is generally comparable.

For example, Czech national standards (link: businesscenter) say this about recognizing revenue (CAS 19. 4.2): "the sale of products and merchandise is, on the basis of relevant documents (such as invoices), credited to the relevant account in account group 60 - Revenue with the corresponding debit made to the relevant account in account group 31 - Receivables (short and long-term) or account group 21 - Cash."

Similarly, French (link: anc.gouv.fr) accounting standard Art. 947-70 (view pdf) states: "… Les montants des ventes, des prestations de services, des produits afférents aux activités annexes sont enregistrés au crédit des comptes 701 "Ventes de produits finis", 702 "Ventes de produits intermédiaires", 703 "Ventes de produits résiduels", 704 "Travaux", 705 "Études", 706 "Prestations de services", 707 "Ventes de marchandises" et 708 "Produits des activités annexes"."

While both standards are clear on the accounts that must be used, they make no mention of the conditions to be met before these accounts are used.

In contrast, IFRS 15.31 | ASC 606-10-25-23 state: ...An entity shall recognize revenue when (or as) the entity satisfies a performance obligation by transferring a promised good or service (i.e. an asset) to a customer. An asset is transferred when (or as) the customer obtains control of that asset....

While IFRS and US GAAP, are clear the condition (transfer of control) for recognizing revenue, they make no mention of the accounts to be used.

Please note: even though we have a world-wide subscriber/client base, we to not claim to be experts in any national GAAP, nor can we advise any entity on how these rules and regulations can or should be applied.

The Income Tax Act 586/1992 §23 (2) states:

"The tax base isdetermined a) from the net income (profit or loss), always without the influence of International Accounting Standards, for taxpayers required to maintain accounts. A taxpayer that prepares financial statements in accordance with International Accounting Standards regulated by European Community shall apply for the purposes of this Act to determine net income and to determine other data decisive for determining the tax base a special legal regulation [CZ GAAP]). When determining the tax base, entries in off-balance sheet account books are not taken into account, unless otherwise provided in this Act. ..."

This implies that even in those situations where a different standard or COA is used for accounting purposes, the result must be adjusted so that net income equals what it would have been if CZ GAAP had been applied throughout the period.

Since these adjustments can be onerous, it is not an approach we recommend to our clients.

A change in law, that would allow IFRS to be used to determine taxable income (thus eliminating this CZ GAAP adjustment) is under consideration.

If this change is implemented, our recommendation will also, depending on how that law is implemented, likely change.

Instead, the approach we recommend is to separate IFRS | US GAAP and national GAAP accounting.

The optimal way to achieve this separation has proved to be:

1. Establish an in-house reporting system designed around the recognition, measurement and reporting requirements of the primary standard (generally the standard the consolidated entity reports in its primary market). For a US listed company, that would be US GAAP. For a EU listed company, that would be IFRS. For a US listed foreign private issuer it could be either.

2. Establish an in-house policy for the adjustments between IFRS and US GAAP (or vice versa).

3. Outsource national GAAP to a licensed national accountant / insured tax advisor .

This recommendation also applies to companies whose reporting obligation does not arise from a stock market listening. For example, we have several clients with subsidiaries located in the United States that are required to use accrual accounting (US GAAP) for US taxation purposes.

Since these companies generally use either IFRS or local GAAP as their primary reporting/accounting system, they tend to outsource their US accounting and tax to US based CPA's, primarily because maintaining a dedicated, in-house team of accountants for this purpose is not a cost effective solution.

The advantage of this approach is that it tends to be cost effective and, provided the service provider is licensed and adequately insured, eliminates (or at lease significantly mitigates) the risks associated with national accounting/tax compliance.

Obviously these recommendations apply primarily to smaller companies rather than multinational enterprises with the budget to maintain separate, in-house teams dedicated to each standard and/or jurisdiction.

Consequently, before applying the CAO available for download from this site for national GAAP purposes, we strongly recommend consulting an accounting and/or legal professional qualified to interpret national legislation.

An additional discussion of what constitutes a comparable standard is provided in the release notes.

Also visit our illustrative examples page: lllustrations

This chart of accounts includes basic IFRS-compatible classifications and sub-classifications.

The IASB does not publish an "IFRS chart of accounts".

Companies may use any chart of accounts, provided it is consistent with published recognition guidance (link: eifrs.ifrs.org).

This chart has been designed to be consistent with this guidance.

While users may delete unnecessary / add additional sub-accounts, they are advised to keep its general structure intact.

Prior to use, users are advised to add additional, specific accounts.

For example, a company with petty cash and two bank accounts, would add:

| Account Title | Account # |

| Assets | 1 |

| --- | --- |

| Cash And Cash Equivalents | 1.9 |

| Cash | 1.9.1 |

| Petty cash | 1.9.1.1 |

| Cash in bank | 1.9.1.2 |

| Cash in bank, account one | 1.9.1.2.1 |

| Cash in bank, account two | 1.9.1.2.2 |

| --- | --- |

A company with customers (i.e. customer # 123, customer # 234, customer number # 345), would add:

| Account Title | Account # |

| Assets | 1 |

| --- | --- |

| Receivables | 1.8 |

| Trade Receivables | 1.8.1 |

| Customer 123 | 1.8.1.123 |

| Customer 234 | 1.8.1.234 |

| Customer 345 | 1.8.1.345 |

| --- | --- |

In addition to permanent accounts, temporary accounts for individual receivables (i.e invoice # 00321, invoice # 00332, invoice # 00358), may also be added:

| Account Title | Account # |

| Assets | 1 |

| --- | --- |

| Receivables | 1.8 |

| Trade Receivables | 1.8.1 |

| Customer 123 | 1.8.1.123 |

| Invoice 00321 | 1.8.1.123-00321 |

| Invoice 00321 | 1.8.1.123-00332 |

| Invoice 00321 | 1.8.1.123-00358 |

| --- | --- |

This chart does not make a current/non-current distinction.

As the current/non-current status of an item is a reporting rather than recognition issue, incorporating this distinction into the account structure not only adds unnecessary complexity but can lead to unnecessary reclassification.

IAS 1.60: An entity shall present current and non-current assets, and current and non-current liabilities, as separate classifications in its statement of financial position in accordance with paragraphs 66 to 76, except when a presentation based on liquidity provides information that is reliable and more relevant. When that exception applies, an entity shall present all assets and liabilities in order of liquidity.

For example, a company can acquire an available-for-sale financial instrument with the intention of holding it for less than 12 months then, during the holding period, change its intention.

Nevertheless, as some companies prefer a chart of accounts that makes this distinction, a current/non-current chart of accounts is available to subscribers.

This chart includes expenses classified by both nature and function.

IFRS requires nature-of-expense disclosure, and permits both function- and nature-of-expense reporting.

IAS 1.104 An entity classifying expenses by function shall disclose additional information on the nature of expenses, including depreciation and amortisation expense and employee benefits expense.

IAS 1.99 An entity shall present an analysis of expenses recognised in profit or loss using a classification based on either their nature or their function within the entity, whichever provides information that is reliable and more relevant.

From an accounting perspective, a nature-based account structure yields superior operational results.

For a more detailed example see: Nature-of-expense, function-of-expense.

For example, if accounts were organized by function, the result would resemble:

| --- | --- |

| Expenses Classified By Function | 5.2 |

| Cost Of Sales | 5.2.1 |

| Emloyee benefits | 5.2.1.1 |

| Wages | 5.2.1.1.1 |

| Salaries | 5.2.1.1.2 |

| --- | --- |

| Selling, General And Administrative | 5.2.2 |

| Emloyee benefits | 5.2.2.1 |

| Wages | 5.2.2.1.1 |

| Salaries | 5.2.2.1.2 |

| Commissions | 5.2.2.1.3 |

| --- | --- |

When accounts are initially organized by nature, the result can resemble:

| Account | Department | ||

| --- | --- | --- | |

| Expenses Classified By Nature | 5.1 | ||

| Employee Benefits | 5.1.3 | ||

| Production department | 5.1.3 | - | 5.2.1 |

| Sales department | 5.1.3 | - | 5.2.2.1 |

| Administrative department | 5.1.3 | - | 5.2.2.2 |

| --- | --- |

Also note, while it would be possible to add a digit for country of domicile, subsidiary, segment, reporting unit etc., in practice it is more practical for each such entity to maintain separate accounts, which are then consolidated:

| Country | Account | Department | |||

| --- | --- | ||||

| Employee Benefits - UK | 1 | - | 5.1.3 | ||

| Production department - UK | 1 | - | 5.1.3 | - | 5.2.1 |

| Sales department - UK | 1 | - | 5.1.3 | - | 5.2.2.1 |

| Administrative department - UK | 1 | - | 5.1.3 | - | 5.2.2.2 |

| --- | --- | ||||

| Employee Benefits - France | 2 | - | 5.1.3 | ||

| Production department - France | 2 | - | 5.1.3 | - | 5.2.1 |

| Sales department - France | 2 | - | 5.1.3 | - | 5.2.2.1 |

| Administrative department - France | 2 | - | 5.1.3 | - | 5.2.2.2 |

| --- | --- |

Updated: May 2024

|

Account Title |

Account # |

Depth |

Balance |

|

Assets |

1 |

0 |

Dr |

|

Property, plant and equipment |

1.1 |

1 |

Dr |

|

Land and Land Improvements |

1.1.1 |

2 |

Dr |

|

Buildings |

1.1.2 |

2 |

Dr |

|

Machinery and Equipment |

1.1.3 |

2 |

Dr |

|

Fixtures and fittings |

1.1.4 |

2 |

Dr |

|

Right of Use Assets (Classified as PP&E) |

1.1.5 |

2 |

Dr |

|

Additional Property, Plant and Equipment |

1.1.6 |

2 |

Dr |

|

Construction in progress |

1.1.7 |

2 |

Dr |

|

Investment property |

1.2 |

1 |

Dr |

|

Investment property completed |

1.2.1 |

2 |

Dr |

|

Investment property under construction or development |

1.2.2 |

2 |

Dr |

|

Goodwill |

1.3 |

1 |

Dr |

|

Intangible assets other than goodwill |

1.4 |

1 |

Dr |

|

Intellectual Property |

1.4.1 |

2 |

Dr |

|

Computer Software |

1.4.2 |

2 |

Dr |

|

Trade and Distribution Assets |

1.4.3 |

2 |

Dr |

|

Contracts and Rights |

1.4.4 |

2 |

Dr |

|

Right of Use Assets (Classified as Intangible) |

1.4.5 |

2 |

Dr |

|

Crypto Assets (Classified as Intangible) |

1.4.6 |

2 |

Dr |

|

Additional Intangible Assets |

1.4.7 |

2 |

Dr |

|

Acquisition in Progress |

1.4.8 |

2 |

Dr |

|

Other financial assets |

1.5 |

1 |

Dr |

|

Non-Derivative Financial Assets |

1.5.1 |

2 |

Dr |

|

Derivative financial assets |

1.5.2 |

2 |

Dr |

|

Additional Financial Assets and Investments |

1.5.3 |

2 |

Dr |

|

Crypto Assets (Classified as Financial) |

1.5.4 |

2 |

Dr |

|

Inventories |

1.6 |

1 |

Dr |

|

Current merchandise |

1.6.1 |

2 |

Dr |

|

Raw Material, Parts and Supplies |

1.6.2 |

2 |

Dr |

|

Current work in progress |

1.6.3 |

2 |

Dr |

|

Current finished goods |

1.6.4 |

2 |

Dr |

|

Other current inventories |

1.6.5 |

2 |

Dr |

|

Accruals and Additional Assets |

1.7 |

1 |

Dr |

|

Prepayments |

1.7.1 |

2 |

Dr |

|

Accrued Income |

1.7.2 |

2 |

Dr |

|

Service Provider Work in Process |

1.7.3 |

2 |

Dr |

|

Additional Assets |

1.7.4 |

2 |

Dr |

|

Receivables and Contracts |

1.8 |

1 |

Dr |

|

Loans and receivables |

1.8.1 |

2 |

Dr |

|

Contracts with Customers |

1.8.2 |

2 |

Dr |

|

Nontrade and Other Receivables |

1.8.3 |

2 |

Dr |

|

Tax Assets |

1.9 |

1 |

Dr |

|

Current tax assets |

1.9.1 |

2 |

Dr |

|

Deferred tax assets |

1.9.2 |

2 |

Dr |

|

Other tax assets |

1.9.3 |

2 |

Dr |

|

Agricultural (Biological) Assets |

1.10 |

1 |

Dr |

|

Bearer Plants |

1.10.1 |

2 |

Dr |

|

Animals |

1.10.2 |

2 |

Dr |

|

Other Agricultural Assets |

1.10.3 |

2 |

Dr |

|

Cash and cash equivalents |

1.11 |

1 |

Dr |

|

Cash |

1.11.1 |

2 |

Dr |

|

Cash equivalents |

1.11.2 |

2 |

Dr |

|

Restricted Cash and Financial Assets |

1.11.3 |

2 |

Dr |

|

Equity |

2 |

0 |

(Cr) |

|

Total equity attributable to owners of parent |

2.1 |

1 |

(Cr) |

|

Issued capital |

2.1.1 |

2 |

(Cr) |

|

Additional paid-in capital |

2.1.2 |

2 |

(Cr) |

|

Retained earnings |

2.2 |

1 |

(Cr) |

|

Appropriated |

2.2.1 |

2 |

(Cr) |

|

Unappropriated |

2.2.2 |

2 |

(Cr) |

|

Deficit |

2.2.3 |

2 |

Dr |

|

Retained earnings, profit (loss) for reporting period |

2.2.4 |

2 |

Dr or (Cr) |

|

Retained earnings, excluding profit (loss) for reporting period |

2.2.5 |

2 |

Dr or (Cr) |

|

In Suspense |

2.2.6 |

2 |

Zero |

|

Treasury shares |

2.2.7 |

2 |

Dr |

|

Other reserves |

2.3 |

1 |

Dr or (Cr) |

|

Reserve of exchange differences on translation |

2.3.1 |

2 |

Dr or (Cr) |

|

Reserve of cash flow hedges |

2.3.2 |

2 |

Dr or (Cr) |

|

Reserve of gains and losses on remeasuring available-for-sale financial assets |

2.3.3 |

2 |

Dr or (Cr) |

|

Reserve of remeasurements of defined benefit plans |

2.3.4 |

2 |

Dr or (Cr) |

|

Revaluation surplus |

2.3.5 |

2 |

(Cr) |

|

Additional AOCI Items |

2.3.6 |

2 |

Dr or (Cr) |

|

Other Equity Items |

2.4 |

1 |

Dr or (Cr) |

|

Stock Receivables |

2.4.1 |

2 |

Dr |

|

Additional Equity |

2.4.2 |

2 |

(Cr) |

|

Non-controlling interests |

2.5 |

1 |

(Cr) |

|

Liabilities |

3 |

0 |

(Cr) |

|

Trade and other payables |

3.1 |

1 |

(Cr) |

|

Trade payables |

3.1.1 |

2 |

(Cr) |

|

Dividend payables |

3.1.2 |

2 |

(Cr) |

|

Interest payable |

3.1.3 |

2 |

(Cr) |

|

Other payables |

3.1.4 |

2 |

(Cr) |

|

Provisions |

3.2 |

1 |

(Cr) |

|

Customer Related Provisions |

3.2.1 |

2 |

(Cr) |

|

Litigation and Regulatory |

3.2.2 |

2 |

(Cr) |

|

Additional Provisions |

3.2.3 |

2 |

(Cr) |

|

Other financial liabilities |

3.3 |

1 |

(Cr) |

|

Notes Payable |

3.3.1 |

2 |

(Cr) |

|

Loans received |

3.3.2 |

2 |

(Cr) |

|

Bonds (Debentures) |

3.3.3 |

2 |

(Cr) |

|

Other Debts and Borrowings |

3.3.4 |

2 |

(Cr) |

|

Lease Obligations |

3.3.5 |

2 |

(Cr) |

|

Derivative financial liabilities |

3.3.6 |

2 |

(Cr) |

|

Accruals, Deferrals and Additional Liabilities |

3.4 |

1 |

(Cr) |

|

Accrued Expenses |

3.4.1 |

2 |

(Cr) |

|

Accrued Taxes (Other than Payroll) |

3.4.2 |

2 |

(Cr) |

|

Deferred Income and Refund Liabilities |

3.4.3 |

2 |

(Cr) |

|

Service Contract Liabilities (Percentage of Completion) |

3.4.4 |

2 |

(Cr) |

|

Additional Liabilities |

3.4.5 |

2 |

(Cr) |

|

Revenue |

4 |

0 |

(Cr) |

|

Recognized Point of Time |

4.1 |

1 |

(Cr) |

|

Goods |

4.1.1 |

2 |

(Cr) |

|

Services |

4.1.2 |

2 |

(Cr) |

|

Recognized Over Time |

4.2 |

1 |

(Cr) |

|

Products |

4.2.1 |

2 |

(Cr) |

|

Services |

4.2.2 |

2 |

(Cr) |

|

Adjustments |

4.3 |

1 |

Dr |

|

Variable Consideration |

4.3.1 |

2 |

Dr |

|

Consideration Paid (Payable) to Customers |

4.3.2 |

2 |

Dr |

|

Other Adjustments |

4.3.3 |

2 |

Dr |

|

Expenses |

5 |

0 |

Dr |

|

Expenses (Classified by Nature) |

5.1 |

1 |

Dr |

|

Material and Merchandise |

5.1.1 |

2 |

Dr |

|

Employee benefits expense |

5.1.2 |

2 |

Dr |

|

Services expense |

5.1.3 |

2 |

Dr |

|

Rent, Depreciation, Amortization and Depletion |

5.1.4 |

2 |

Dr |

|

Increase (decrease) in inventories of finished goods and work in progress |

5.1.5 |

2 |

Dr or (Cr) |

|

Other work performed by entity and capitalised |

5.1.6 |

2 |

Dr |

|

Expenses (Classified by Function) |

5.2 |

1 |

Dr |

|

Cost of sales |

5.2.1 |

2 |

Dr |

|

Selling, general and administrative expense |

5.2.2 |

2 |

Dr |

|

Uncollectible Accounts Expense (Reversal) |

5.2.3 |

2 |

Dr or (Cr) |

|

Other (Non-Operating) Income and Expenses |

6 |

0 |

Dr or (Cr) |

|

Other Revenue and Expenses |

6.1 |

1 |

Dr or (Cr) |

|

Other Revenue |

6.1.1 |

2 |

(Cr) |

|

Other Expenses |

6.1.2 |

2 |

Dr |

|

Gains and Losses |

6.2 |

1 |

Dr or (Cr) |

|

Foreign Currency Transaction Gain (Loss) |

6.2.1 |

2 |

Dr or (Cr) |

|

Gain (Loss) on Investments |

6.2.2 |

2 |

Dr or (Cr) |

|

Gain (Loss) on Derivatives |

6.2.3 |

2 |

Dr or (Cr) |

|

Crypto Asset Gain (Loss) |

6.2.4 |

2 |

Dr or (Cr) |

|

Gain (Loss) on Disposal of Assets |

6.2.5 |

2 |

Dr or (Cr) |

|

Debt Related Gain (Loss) |

6.2.6 |

2 |

Dr or (Cr) |

|

Impairment Loss |

6.2.7 |

2 |

Dr or (Cr) |

|

Other Gains and (Losses) |

6.2.8 |

2 |

Dr or (Cr) |

|

Taxes (Other than Income and Payroll) and Fees |

6.3 |

1 |

Dr |

|

Tax income (expense) |

6.4 |

1 |

Dr or (Cr) |

|

Intercompany and Related Party Accounts |

7 |

0 |

Dr or (Cr) |

|

Intercompany and Related Party Assets |

7.1 |

1 |

Dr |

|

Intercompany Balances (Eliminated in Consolidation) |

7.1.1 |

2 |

Dr |

|

Related Party Balances (Reported or Disclosed) |

7.1.2 |

2 |

Dr |

|

Investments in subsidiaries, joint ventures and associates reported in separate financial statements |

7.1.3 |

2 |

Dr |

|

Intercompany and Related Party Liabilities |

7.2 |

1 |

(Cr) |

|

Intercompany Balances (Eliminated in Consolidation) |

7.2.1 |

2 |

(Cr) |

|

Related Party Balances (Reported or Disclosed) |

7.2.2 |

2 |

(Cr) |

|

Intercompany and Related Party Income and Expense |

7.3 |

1 |

Dr or (Cr) |

|

Intercompany and Related Party Income |

7.3.1 |

2 |

(Cr) |

|

Intercompany and Related Party Expenses |

7.3.2 |

2 |

Dr |

|

Income (Loss) from Equity Method Investments |

7.3.3 |

2 |

Dr or (Cr) |

The COA published on this page may be republished provided the following citation is provided: