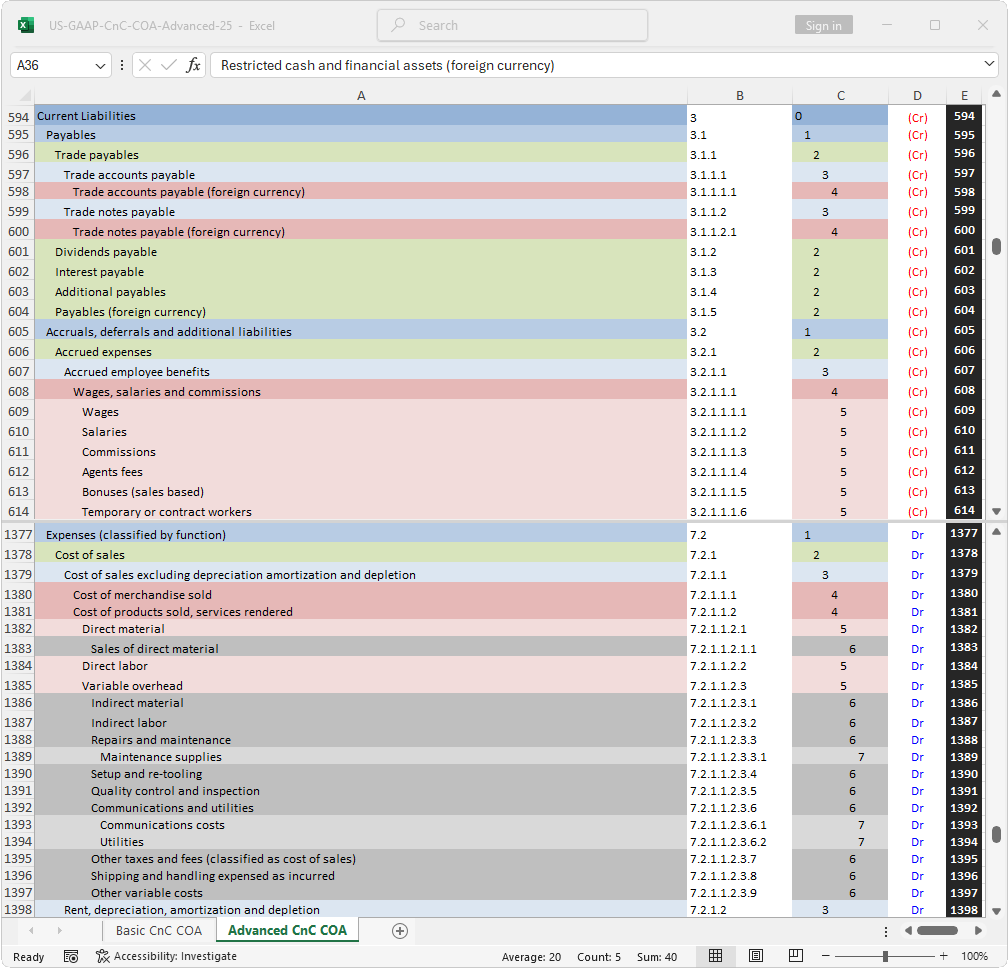

This chart of accounts includes classifications and sub-classifications consistent with US GAAP recognition guidance.

The FASB does not define a US GAAP chart of accounts.

Companies may define any chart of accounts, provided it is consitent US GAAP recognition guidance (link: asc.fasb.org).

The chart of accounts presented on this page has been designed to supoort this reporting guidance.

Its structure can be expanded, but should not be altered.

eXtensible Business Reporting Language is a reporting language.

"In a nutshell, XBRL provides a language in which reporting terms can be authoritatively defined. Those terms can then be used to uniquely represent the contents of financial statements or other kinds of compliance, performance and business reports. XBRL lets reporting information move between organisations rapidly, accurately and digitally" (link: xbrl.org).

It is not a chart of accounts.

The chart of accounts presented here includes XBRL cross references to ease the drafting of XBRL taged financial reports.

Some items necessary for accounting do not have a defined (link: xbrlview.fasb.org) XBRL counterpart. These items are labled "_Extension" and presented in a different color to avoid confusion.

Prior to use, users are advised to adding thier own, specific accounts.

For example, a company with petty cash and two bank accounts, it would add accounts:

| Assets | 1 |

| Cash And Investments | 1.1 |

| Cash And Cash Equivalents | 1.1.1 |

| Petty Cash | 1.1.1.1 |

| Cash in bank | 1.1.1.2 |

| Cash in bank, account one | 1.1.1.2.1 |

| Cash in bank, account two | 1.1.1.2.2 |

| --- | --- |

A company that maintains separate accounts for individual customers (i.e. customer # 123, customer # 234, customer number # 345), would add (pernanent) accounts:

| Assets | 1 |

| --- | --- |

| Receivables | 1.2 |

| Accounts, Notes And Loans |

1.2.1 |

| Accounts receivable | 1.2.1.1 |

| Customer 123 | 1.2.1.1.123 |

| Customer 234 | 1.2.1.1.234 |

| Customer 345 | 1.2.1.1.345 |

| --- | --- |

A company that maintains separate accounts for individual receivables

(i.e invoice # 00321, invoice # 00332, invoice # 00358), would add temporary

accounts:

| Assets | 1 |

| --- | --- |

| Receivables | 1.2 |

| Accounts, Notes And Loans |

1.2.1 |

| Accounts receivable | 1.2.1.1 |

| Customer 123 | 1.2.1.1.123 |

| Invoice 00321 | 1.2.1.1.123-00321 |

| Invoice 00321 | 1.2.1.1.123-00332 |

| Invoice 00321 | 1.2.1.1.123-00358 |

| --- | --- |

This chart makes a current/non-current distinction.

The current / non-current distinction is a disclosure rather than a recognition issue.

For example, an entity's unconditional right to consideration is a receivable (ASC 606-10-45-4) regardless of whether the payment is due in more or fewer than 12 months.

For this reason, this site recommends always using an order of liquidity chart of accounts where an item's current / non-current status is treated as an account attribute (see the expanded COA) rather than a separate account.

This approach is not only theoretically valid but has practical consequences. For example, if a current-non-current COA is used, a long-term receivable would be initially recognized in one account, then, when its due date drops below one year, it would need to be derecognized and re-recognized to a different account. Obviously, this requires more effort and is more prone to error or oversight than if the only change needed was an adjustment to an account attribute.

Nevertheless, for pedantic and historical reasons, some practitioners insist on a current/non-current distinction at the account level. While we do not see any logic in this approach, this site does respect its users' preferences, so it includes a current-non-current COA, although it does not recommend using it.

Note: using a COA that includes attributes while, at the same time, not treating an item' current/non-current status as an attribute makes little sense. To emphasize this point, we ceased publishing an expanded current/non-current COA.

This chart includes expenses classified by both nature and function.

Unlike IFRS, US GAAP does not permit nature of expense disclousure.

Nevertheless, from chart of accounts perspective, it is far easier to organize accounts nature than by function.

For a more detailed example see: Nature of expense, function of expense.

For example, to recognize expenses by function, the account structure would need, for example, to be:

| Expenses Classified By Function | 5.1 | |

| Cost Of Revenue | 5.1.1 | |

| Cost Of Goods Sold | 5.1.1.1 | |

| Emloyee benefits (wages and salaries) | 5.1.1.1.1 | |

| Wages | 5.1.1.1.1.1 | |

| Salaries | 5.1.1.1.1.2 | |

| etc. | ||

| Cost Of Services Rendered | 5.1.1.2 | |

| Emloyee benefits (wages and salaries) | 5.1.1.2.1 | |

| Wages | 5.1.1.2.1.1 | |

| Salaries | 5.1.1.2.1.2 | |

| etc. | ||

| Selling, General, Administrative | 5.1.2 | |

| Selling and Marketing | 5.1.2.1 | |

| Emloyee benefits (wages and salaries) | 5.1.2.1.1 | |

| Salaries | 5.1.2.1.1.2 | |

| Commissions | 5.1.2.1.1.3 | |

| etc. |

Not a particularly practical way to organize accounts.

The better option to define accounts by nature and capture the function of each expense on a second, department or unit level.

| Account | Department | |

| Expenses Classified By Nature | 5.2 | |

| Employee Benefits | 5.2.2 | |

| Production department | 5.2.2 | 5.1.1.1 |

| Service department | 5.2.2 | 5.1.1.2 |

| Sales department | 5.2.2 | 5.1.2.1 |

| Administrative department | 5.2.2 | 5.1.2.2 |

XBRL cross references.

This current/noncurrent COA includes limited XBRL cross references.

The order of liquidity COA (COA with XBRL) presents additional items.

The Excel download page includes:

- Basic COA

- Advanced COA

Updated February 2025.